Concept / Object / Purpose of Negotiable Instrument Act No Case Made Out If Cheque Amount Is More Than Liability

The object is to provide legal protection to different mercantile instruments. The Act regulates the issues in negotiation of the instruments as mentioned in this Act. In case of no explicit provisions in the Act, the rights and obligations of the respective parties shall be governed by the provisions of Contract Act Negotiable instruments are one of the modes of settlement of transactions. Transactions can be settled through cash or any other mode. No Case Made Out If Cheque Amount Is More Than Liability

For example, through a cheque and other negotiable instruments

Meaning of Negotiable Instrument Act No Case Made Out If Cheque Amount Is More Than Liability

Negotiable means the quality of transfer ability by delivery or by endorsement and delivery. Instrument means a written document by which a right is created in favor of some person. Negotiable Instrument means a written document, which is freely transferable and which creates a right in favor of some person to receive some money.

Section 13 – Negotiable Instruments No Case Made Out If Cheque Amount Is More Than Liability

(1) Negotiable instrument. A Negotiable Instrument means a promissory note, bill of exchange or cheque payable either to order or to bearer.

Explanation (i).-A promissory note, bill of exchange or cheque is payable to order which is expressed to be so payable or which is expressed to be payable to a particular person, and does not contain words prohibiting transfer or indicating an intention that it shall not be transferable.

Explanation (ii).-A promissory note, bill of exchange or cheque is payable to bearer which is expressed to be so payable or on which the only or last endorsement is an endorsement in blank.

Explanation (iii).-Where a promissory note, bill of exchange or cheque, either originally or by endorsement, is expressed to be payable to the order of a specified person, and not to him or his order, it is nevertheless payable to him or his order at his option.

(Click Here To Know About Cheque Bouce Rules In India)

(2) A negotiable instrument may be made payable to two or more payees jointly, or it may be made payable in the alternative to one of two, or one or -some of several payees.

No Case Made Out If Cheque Amount Is More Than Liability

In Financial transactions when any person gives is/her blank cheque against the his/her debt liability to the any person and if said person filled that cheque woth higher amount than legal debt liability, in that case if accused person proves that cheque amount is more that legal debt liability than complaint may be dismissed.

What if Complainant Filled Cheque Amount More Than Legal Debt Liability of Accused ?

Answer: No Case Made Out If Cheque Amount Is More Than Legal Debt Liability.

Judicial Interpretation On This Preposition

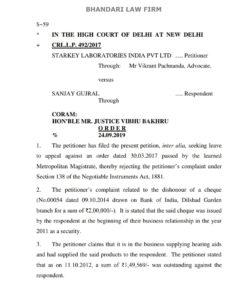

Delhi High Court has refused to grant leave to appeal in a cheque bounce case where the accused was acquitted since the cheque amount was more than the liability.

A bench of Justice Bakhru has passed the order in the case titled as STARKEY LABORATORIES INDIA PVT LTD vs SANJAY GUJRAL on 24.09.2019.

The petitioner’s complaint related to the dishonour of a cheque (No.00054 dated 09.10.2014 drawn on Bank of India, Dilshad Garden branch for a sum of Rs.2,00,000/-). It is stated that the said cheque was issued by the respondent at the beginning of their business relationship in the year 2011 as a security.

The petitioner claims that it is in the business supplying hearing aids and had supplied the said products to the respondent. The petitioner stated that as on 11.10.2012, a sum of RS. 1,49,569/- was outstanding against the respondent.

It was the respondent’s case that their accounts had been settled as he had returned certain products, which had been supplied to him and the credit for the same had not been accounted for.

The undisputed facts are that the petitioner was in possession of a blank cheque furnished by the respondent. As per the books of the petitioner, a sum of Rs. 1,49,569/- was outstanding as on 11.10.2012. However, the petitioner waited for over two years to fill an amount of RS. 2,00,000/- in the said blank cheque and deposited the same. According to the petitioner, the amount of RS. 1,49,569/- had increased to RS. 2,16,247/- as on the date of depositing the cheque, on account of interest calculated at the rate of 24% per annum.

The trial court had noted that there was no contract or arrangement whereby the respondent had agreed to pay any interest.

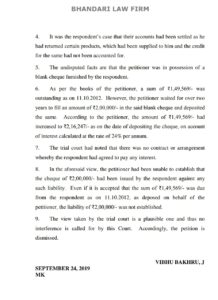

High Court observed and held as under:

“In the aforesaid view, the petitioner had been unable to establish that the cheque of RS. 2,00,000/- had been issued by the respondent against any such liability.

Even if it is accepted that the sum of RS. 1,49,569/- was due from the respondent as on 11.10.2012, as deposed on behalf of the petitioner, the liability of RS. 2,00,000/- was not established.

The view taken by the trial court is a plausible one and thus no interference is called for by this Court. Accordingly, the petition is dismissed”.

Read Full Judgment Here